IRA Eligible Precious Metals

Please select one of the top Here gold IRA companies below to learn more about their offerings. It is a great company that has a lot to offer investors. If you have an existing Individual Retirement Account, we’ll help you transfer or roll it into silver, gold, or platinum. If you want to have your gold graded, it’s typically better to wait until after you’ve liquidated your IRA assets and taken possession of your metals. Below is the minimum fineness required for a gold and silver IRA. They’re recognized as an industry leader because of their efforts to educate consumers on the best way to turn precious metals into long term investments. The knowledgeable professionals at RC Bullion can recognize the types of bullion items that are likely to become rare and valuable in the future due to their extensive knowledge. Some clients will love Augusta Precious Metals, while others might prefer Goldco. Self Directed IRA You control what investment assets to hold in the account such as real estate, precious metals, mutual funds, hedge funds, REITs, bonds etc. It impacts society in too many ways, and many technological advancements would become obsolete. Are you sure you want to empty the cart. Clients who are planning for their retirement often spend some time learning about their options, so they might know they can open traditional IRAs.

5 Noble Gold: Best for Retirement Planning

How Are Inflation and Gold. Therefore, if inflation rates start increasing, customers might buy physical precious metals because they know their money will be safe. Add funds to your account manually or set up a rollover from an existing IRA or 401k. It offers a price match guarantee and a 24 hr purchase guarantee. For those looking to add a precious metals IRA to their investment portfolio, Noble Gold Investments offers an excellent option for gold and other silver IRAs. Experience the Benefits of Investing with RC Bullion. With a broad selection of gold and other precious metals, attractive rates and fees, and excellent customer support, Advantage Gold is an ideal choice for those considering gold IRA investments.

Reviews from TrustPilot

Precious metal bullion must also meet certain fineness requirements in order to be included. Some of the best gold IRA company options on our list take care of the rollover process on behalf of their customers. These depositories have locations in Texas, Delaware, Utah, New York, and California, and you can choose the one closest to you to give you more peace of mind about your investment. The safety and security of your precious metals IRA is extremely important. He currently oversees the investment operation for a $4 billion super regional insurance carrier. IRS requires that all self directed IRA transactions be managed under an IRS approved custodial institution. Traditional IRAs are subject to an early withdrawal penalty of 10% if you take money out before age 59 1/2. Their team wants to make sure you understand physical gold and silver as an investment whether you purchase within an IRA or with CASH. The specialist has a good understanding of the industry and will get to know your financial goals and dreams. The first step in the gold IRA rollover process is to open a gold IRA account. The Bureau’s investigation showed that the high cost loans violated licensing requirements or interest rate caps – or both – that made the loans void in whole or in part in at least 17 states: Arizona, Arkansas, Colorado, Connecticut, Illinois, Indiana, Kentucky, Massachusetts, Minnesota, Montana, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, and South Dakota. Many of these companies are also registered with the internal revenue service IRS, making them more trustworthy for potential IRA customers, especially those worried about whether they can trust their precious metal dealer. This means that an independent third party will physically audit your account every year to ensure that your metals are where they say they are.

3 American Hartford Gold

You can rollover or transfer the following types of accounts into a precious metal IRA. They’ve been in business over a decade and have racked up hundreds of positive customer reviews online. The IRS also caps the annual contributions allowed for gold IRA investments. Related: Please see “Beware proof gold and silver American Eagles including graded PF70, American Buffalos and Eagles graded MS70″. Gold is a good investment that will increase in value with time. You can also utilize the Required Minimum Distribution calculator to discover how much you must withdraw from your gold IRA in retirement per IRS regulations. There are several factors to consider when planning a distribution from your gold IRA. They offer a variety of IRA options, including self directed IRAs, and work closely with clients to help them make informed investment decisions. Is there a minimum IRA purchase. Second, it provides competitive prices for its gold purchases. Precious metals and rare coins are speculative purchases and involve substantial risks. The company offers a wide range of services, from gold IRA rollovers to gold IRA transfers, making them one of the best gold IRA companies around.

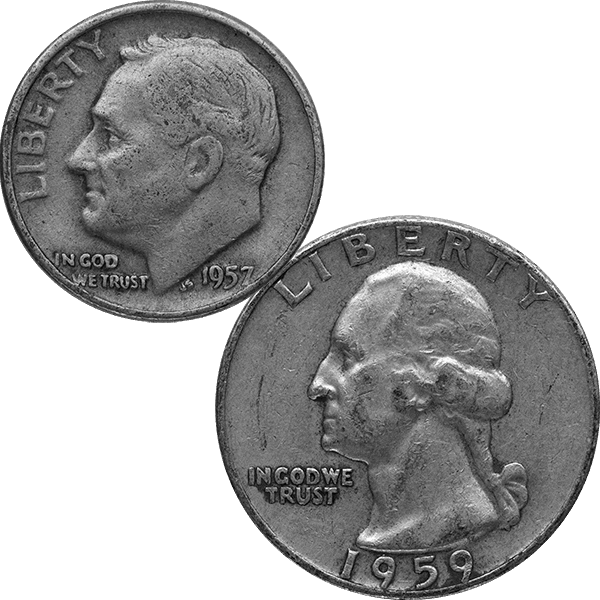

Gold Eagles specifically approved for IRAs

It has already made quite a splash in the industry with precious metal IRA offerings. With almost a decade of experience in protecting customers’ retirement savings, Goldco is a top choice for those considering a gold IRA rollover or new gold IRA. Please note: Pricing and availability are subject to change without notice. The business model adopted by the company involves a flat rate fee structure which may be beneficial for customers who frequently purchase in large quantities. And was also endorsed by the talk show host and conservative political commentator Sean Hannity and American radio personality Stew Peters. A: No, it must be newly purchased bullion where the order is settled through your custodian.

Storage Fees

The financial protection precious metals offer plus the tax savings an IRA provides is a win win combo. At your request, you are being redirected to a third party site. These include coins that have been graded or certified as meeting the fineness test. They also offer competitive prices and a wide range of gold IRA options. The company offers a wide range of gold options, from coins to bars, allowing customers to diversify their gold IRA portfolio. View All Gold IRA Products.

Augusta Precious Metals: Pros Gold IRA Rollover

You should place a small portion of your funds, preferably under 10%, in this alternative investment. In contrast, a precious metals IRA is a retirement account funded with physical gold, silver, platinum, or palladium. There are, however, many more market averse investors who suggest going far beyond that mark. Many investors fund a gold IRA with funds from a 401k or traditional IRA. They also provide competitive rates and secure storage solutions for silver investments. The American Hartford Gold Group is known for their personalized approach to Gold IRA investing.

GoldCo: Cons Gold and Silver IRA

It also covers the storage and insurance costs for the gold bullion. Unlock Value and Savings with GoldCo. Related article: Best Gold IRA Companies: Reviews and Comparison. Find out how to protect your wealth and hedge against inflation by owning precious metals in your retirement account. Before doing that, however, consider checking your returns one more time to see if there’s anything that might save you money and make tax filing season easier next year. In any financial conditions, using a retirement account to invest in gold and other precious metals can reduce or eliminate your taxes on any profits. Therefore, customers will have to pay if they want to open an account. With careful planning and research, a Silver IRA can be a great way to hedge against risk and provide a secure future for your investments. Silver IRA: Similar to a Gold IRA, a Silver IRA allows individuals to invest in physical silver bullion or coins within an individual retirement account. Investing in IRA approved silver can provide investors with a robust and reliable investment option. Their secure storage facilities and wide selection of coins and bars make them an excellent choice for investors looking to diversify their retirement portfolio.

REQUEST YOUR FREEGOLD IRA KIT NOW!

Secure Your Financial Future with American Hartford Gold Group. A: In order to open a Gold IRA Rollover, investors must meet certain requirements, including having a valid Social Security number, being at least 18 years of age, and having enough funds to purchase the desired gold. However, those who purchase small amounts infrequently may find that the total cost, including shipping and storage, outweighs the value of the product. Your best assurance of quality will be in choosing a reputable dealer. Choosing the right precious metal IRA companies to work with is a process that involves quite a bit of research. The Lady Liberty coin series is minted by world renowned, Swiss based PAMP. American Gold Eagle coins are the only gold coins specifically approved for IRAs. Gold IRAs allow investors to own physical gold, silver, platinum, and palladium, as well as other precious metals. The old age threshold was 70.

Top Rating on TrustLink

Many of these companies only offer investments in gold and silver, while others offer platinum and palladium as well. Diversifying your assets even further is the fact that these products can come in precious metal coins, bullions, and bar form, and can be sourced from multiple countries. Each of these brands offers comprehensive services to help investors diversify their portfolios and protect their retirement savings. 5 million are charged 0. The best way is by investing in gold and silver coins or bullion that meet certain requirements set by the IRS. The traditional self directed IRA account placed with a solid trust company is still the safest avenue for the retirement investor and the one most likely to deliver the intended results. To contact American Hartford Gold, call 877 672 6779 or request a free starter kit. After that, all you have to do is wait for your assets to be transferred into your new account. 6 metric tons in Q3 of 2021. So, should you limit yourself to “IRA Approved” bullion products. You can choose which broker will hold your products for you. With the Oxford Gold Group, customers can rest assured that their investments are safe and secure. Silver American Eagle 99.

Contact

As an example, $10,000 invested in gold in 1980 is worth more than $400,000 today. With competitive rates and exceptional customer service, Lear Capital is the ideal choice for those looking to invest in silver IRA. A: A silver IRA account is different from a traditional IRA account in that it allows investors to hold physical silver as an investment, whereas a traditional IRA typically holds paper assets such as stocks, bonds, and mutual funds. Click here to sign up for our newsletter to learn more about financial literacy, investing and important consumer financial news. In this case, you can give your lender your appraisal report or insurance policy, which should answer any questions about an asset’s current value. You want to diversify your retirement portfolio.

Augusta Precious Metals

These contracts bind the state to repay you plus interest after a specific time, regardless of what happens. It offers a wide selection of precious metals IRAs to choose from. Invest in Your Future with Birch Gold: Secure Your Financial Freedom Today. Gold coins, on the other hand, are typically minted by the government and are considered legal tender. When available, we asked them to send us starter kits we could analyze and learn from. Even though it’s not all when it comes to choosing the best business, it does say a lot about it. Their commitment to providing quality service and products makes Birch Gold Group a great choice for those considering investing in gold and silver IRA. Additionally, Direct Bullion cannot provide tax or legal advice and will not advise as to the tax or legal consequences of purchasing or selling precious metals or opening a Precious Metals IRA. This company has risen to the top because of its commitment to making the investment process simple and transparent. You’ll pay a $200 annual fee for Lear to manage your IRA. Products like bullion coins, bars, and numismatic collectible coins can protect your wealth through these uncertain financial times. You’ll also have to budget for annual custodial fees, which tend to be higher than traditional IRA management costs.

ReadLocal

Generally, storage fees should range from $50 to $300 annually. Another important factor to consider is the fees associated with the gold IRA rollover. And if you ever need assistance understanding your options, Goldco provides personalized consultations at no additional cost – allowing you to make informed decisions without feeling overwhelmed by choices. With the abundance of resources available to choose from there’s no reason to get on board today. We placed American Hartford Gold in our top five because of their strong dedication to helping individuals and families invest in their futures. Traditional investment vehicles such as stocks, mutual funds, or bonds rely heavily on the strength of the overall economy, leaving investors vulnerable to inflation and market volatility. It is important to choose a custodian who is reliable and reputable. After funding your account, all that’s left is purchasing from a list of IRA approved gold, silver, platinum, or palladium. Dealers shipped the least desirable and most difficult to market items. In most cases, the process takes place without any penalties because the experts at Goldco understand the ins and outs of dealing with IRS rules and regulations.

Photo from Pexels

A price match guarantee. Gold and silver have long been considered safe havens and are known to have retained their value over time. It’s always good to hedge your bets. With their competitive rates and customer centric approach, Patriot Gold Club is one of the best gold IRA companies, making it a great choice for those looking to invest in gold. All products are presented without warranty. Finally, Augusta Precious Metals made compliance and transparency a key part of their business. No option to buy precious metals such as platinum or palladium. In the long run, gold bars typically perform better than gold coins. Whichever option you end up choosing, take a moment to speak to a financial advisor for a second opinion. The content on this website, including any positive reviews of these companies and other reviews, may not be neutral or independent. Opening an account with a reputable gold IRA company allows you to diversify your portfolio and hold this asset. Noble Gold is one of the newer gold investment companies. Silver has long been known as an excellent choice for an Individual Retirement Account IRA.

Excellence is an understatement

Looking up a company’s performance through the Better Business Bureau is one approach, and you can also find customer reviews on platforms such as Trustpilot. Silver IRAs are good because they allow you to diversify your investment portfolio with different assets. You can choose to have a credit card on file with MWIRA for our administration fees as they arise or pay for the transaction fees and a year of recordkeeping fees in advance, in this case you are not required to have $500 in your IRA. A good buyback program can help quell the anxiety because you won’t be stuck with your gold. On the other hand, a precious metals retirement account allows you to store gold and other precious physical metals, as the name implies. When this happens, it’s often referred to as a bear market — because share prices have dropped so low they look like they belong to bears. Upon request, your current custodian can cut a check from your retirement account and mail it to you directly.